How To File For Alaska Unemployment

This page provides information on how to file for unemployment in Alaska. If you lost your job or your hours were reduced at no fault of your own, you may qualify to receive unemployment benefits in your state. Review the information below, if you still have questions or issues about these benefits, then we suggest to contact your local Alaska Unemployment Department for assistance. It is important that you file your new claim right away because Alaska unemployment insurance are not retroactive.

If you live in Alaska and need to file unemployment, then read the information listed below. It is recommended that you apply for Alaska unemployment benefits immediately when you become unemployed or are working less than full time. Weekly benefits are not paid retroactively. If you are not a US citizen, you can still be eligible for unemployment insurance. You must have been legally authorized to work in the US during the period the wages in which your claim was based on were earned along with being legally authorized to work in the US at the time of filing your new claim. At the time of opening your new claim, you will be required to provide documentation of your work authorization which will be verified through the US Department of Homeland Security system.

Alaska UI Eligibility Requirements

In order to be eligible for unemployment benefits in Alaska you must:

- Have earned wages from covered employment during the base period

- Have a total gross income of $2,500 earned over two calendar quarters of the base period

- You must maintain your eligibility while receiving benefits by being able and available for full time work, actively seeking and reporting weekly work searches and registering for work as required

Covered employment is work done for an employer who is required by Alaska Statute to pay UI tax for their workers. A base period is a time period of 18 months used to determine your monetary eligibility for a Alaska UI claim. The wages you earned in covered employment during this time period determines your monetary eligibility. There are 2 base periods which can be used to determine monetary eligibility:

- Regular base period

- Alternate base period

A regular base period is the first four of the last five completed calendar quarters, immediately preceding the effective date of your new claim. This is the first base period which will be looked at to determine if you are monetarily eligible.

Under a regular base period, if you are not eligible for UI benefits, you may be potentially eligible under the alternate base period. An alternate base period is the last four completed quarters prior to the effective date of your new claim. The alternate base period allows more recently earned wages to be calculated for monetary eligibility.

How to apply for Alaska Unemployment benefits

The easiest and fastest way to file your unemployment claim is to use their online system at my.alaska.gov. It allows you to apply 24 hours a day, 7 days a week. When you go to their website click on the "Unemployment Insurance Benefits" link. You can speak to a claims representative by calling the call center which is available Monday through Friday 10am to 3pm. Once you open your claim you will be required to file bi-weekly claims. You can file for bi-weekly claims online at my.alaska.gov or call VICTOR, the automated telephonic system.

If you are unable to file online, you can file by phone using the automated filing system VICTOR. VICTOR does not provide full service and has limited hours. Alaska residents more than 55 road miles from an Alaska job center can file Wednesday through Saturday from 6am to 7pm AST. All other VICTOR filers can file on Thursdays from 6am to 7pm. Call the number closest to your community listed below:

| Area | Phone Number |

|---|---|

| Anchorage | 907-277-0693 |

| Fairbanks | 907-451-6126 |

| Juneau | 907-586-4650 |

If you are located in a remote location that has been determined to be undeserved for Broadband Internet service you may still have access to the toll-free number at 888-222-9989. When applying for Alaska unemployment benefits, the following information will be required:

- Your Social Security Number

- Dates of your last employment, first and last day worked

- Earnings you made in the last week of your employment

- For non US citizen, you will need your alien registration number and work permit type or other documentation that authorizes your employment in the US

- Other deductible income received in the last week of employment; such as vacation, severance or bonus pay

- Federal employees are required to mail or fax copies of standard form SF8 and SF50, and when possible a Leave and Earnings Statement (LES)

- Name, mailing address and phone number of your last employer and the location where you reported to work

- Ex-military personnel are required to mail or fax a copy of the DD214 member 4

- Ex-military personnel can obtain these documents at archives.gov/veterans

- Ex-personnel of the Department of Defense can obtain records at www.dfas.mil

When you create a new claim, it goes into effect on the Sunday of the week in which you filed your new claim for UI benefits.

How much will be my weekly benefit amount

In Alaska, you can receive a minimum weekly benefit amount of $56 up to a maximum of $370 per week. Your monetary determination will state your weekly benefit amount and how many weeks of benefits you are potentially eligible for. To calculate how much your weekly benefits amount will be, download this worksheet.

During the base period, if you worked in Alaska and in other states then you may be eligible for a combined wage claim. Any earnings from covered employment in any state during the past 18 months may potentially be combined to establish a new claim. You may potentially choose to file a combined wage claim in any of the states where you have worked. Report all work in all states when opening your claim as it may result in a higher weekly benefit amount.

If you open a claim online and report earnings from another state, you will be responsible to contact the claim center. By law, you must give Department of Labor Workforce Development permission to add wages earned in another state to your Alaska claim. States have different weekly benefit amounts.

Once you have filed your new Alaska unemployment claim, you will be sent a monetary determination in the mail stating the amount of benefits you are eligible for and the wages which the determination was based on. If there are any errors it is up to you to report this to a claim center immediately.

If your wages are from the federal government or US Military, your monetary determination may state you are ineligible at this time because your wages have not been reported. Once wage proof has been received, you will receive a second monetary determination based on the newly reported wages. It is your responsibility to submit wage proof when requested by the claim center.

All new claims submitted are subject to what is called a waiting week. The waiting week is the first week in which you were eligible to receive benefits. You will not receive payment for this week, however you must claim for this week to receive your waiting week credit. It will not be deducted from your benefit amount.

You will be required to file bi-weekly claims and be able and available for full time work. You will be required to register for work within 7 days, unless deferred. Also, unless deferred, you will also be required to report weekly work search contacts for each week you claim.

Filing Biweekly Claims

Once you've opened a new claim or reopened an existing claim, you will be given dates as to when to file your bi-weekly claims. You must continue to file every two weeks to keep your claim active and to receive benefits. File within 7 days after the last Saturday of your 2 week claim period. Weeks that are filed late may be disqualified. The first eligible week of a new claim is a waiting week. You do not receive payment for this week. However, you must file to get credit for the week and meet the same requirements as any other week.

Each of the questions on the biweekly UI benefits application pertains only to the 2 weeks listed on the form. Depending on your answers, you may be asked additional questions or to complete a questionnaire.

- Were you available and physically able to work full time each day?

- Did you miss work or refuse a job offer or job referral? If you turned down work or refused to be scheduled for work by an employer, answer yes.

- Were you attending school or a training program?

- Did you travel or move to a different town? If you traveled outside the area in which you reside, traveled to accept a definite offer of work or if you relocated to a new town, answer yes.

- Did you receive vacation, sick, retirement, bonus, holiday or severance pay? If you received any of the above payments report the income in the week it was received. Do not report Social Security. If you answer yes but do not report an amount, you will be advised to contact the UI claim center. Failure to contact the claim center as advised may result in the denial or late payment of your benefits.

- Did you work for an employer, or were you self-employed? If you worked for an employer, whether it is full-time, part-time, temporary, casual/day labor, etc. you are required to report the amount you earned, hours you worked, the employer's name and address, and the last day you worked in the week you are claiming. You must report the wages that you earned in the week that you worked not when you are paid for the work. If you performed self-employment services, you must report the amount of hours you spent on your business and your net income.

- Did you search for work? You are required to provide information on weekly work search contacts.

Available Payment Methods

Unless direct deposit has been established, payments will be automatically dispensed through a debit card. Electronic payment is typically deposited within 3 business days of filing your bi-weekly certifications. You can sign up for direct deposit or a debit card online. Unless you establish direct deposit, a debit card and information packet will be mailed to you when you file a claim for benefits. Included in the packet is information on how to activate your card and contact numbers for customer service. KeyBank's toll-free customer service number is 866-295-2955.

If you want to use direct deposit then you can set up, reactivate or cancel your direct deposit by selecting "Direct Deposit" through their online Benefit Internet Filing system. You will need the following information to establish direct deposit:

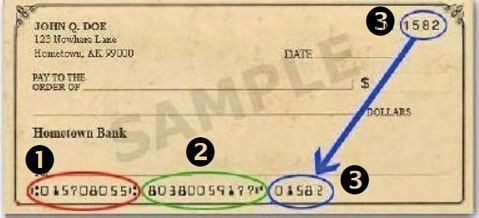

- The routing number is 9 digits surrounded by |:

- The account number (do not include hyphens or other special characters)

- Do not enter the check number

Please note, direct deposit is automatically suspended if it has not been used for a year or more. Your benefits will be issued by debit card until direct deposit is re-established.

Appealing Unemployment Claims

You may appeal any written determination that denies or restricts your benefits. You must phone, fax, mail or email your request for an appeal to your UI claim center or an Appeals office within 30 days of the decision. Appeals will schedule a hearing and mail a notice to you. After the hearing, you will receive a decision in the mail. If you disagree with the decision, you have the right to further appeal. The appeals contact information is listed below:

| Method | Contact |

|---|---|

| appeals@alaska.gov | |

| Online | labor.alaska.gov/appeals |

| Fax | 907-465-3374 |

| Toll Free | 800-232-4762 |

| Mailing Address | Juneau: P.O. Box 115509 JUNEAU, AK 99811-5509 |